Adviser Blog

To get future essays sent straight to your inbox, sign up for our monthly adviser newsletter.

Panic Is Spreading Faster Than Prices Are Falling

The world has changed. The speed and intensity of information has changed. But the fundamentals of good behavioural financial advice haven’t. Help your clients to stay calm and stay the course. Only we can help them them to stick to the plan when it matters most.

Two Good Years

So, as you power through your meetings, don’t just celebrate the good times. Use them to prepare clients for the future, whatever that may hold. Because after two good years, we know one thing for sure: smooth sailing never lasts forever.

Another Year the Stock Market Defied the Headlines

It’s important for us to remember a timeless truth: markets are unpredictable and unknowable in the short term but remarkably consistent over the long term.

Choose Your Poison

If we can work together to build a bridge between our roles, we can foster a future where compliance elevates our service rather than hinders it. In doing so, we can protect and enhance our clients' financial futures, ensuring they are well-served both now, and the future lives they need to fund.

Mise en Place for Financial Advisers

Financial advisers can maintain an organised, efficient approach to business and client management by adopting the’ mise en place’ mindset. What do you need to do before the end of the year so that you are “working clean” in 2025?

The Double-Edged Sword: Media as a Friend and Foe to Financial Advisers

While the media may be a foe in spreading fear, they also remind us why our role is so critical. It's up to us to cut through the noise, keep our clients focused, and help them achieve their financial goals. The good we do as real advisers is not just about managing money but protecting our clients from the forces that could derail their financial success.

When the Punishment is Actually the Reward

Sometimes, breaking the rules has unexpected benefits. And sometimes, the best punishments are the ones that let you off the hook in the most hilarious ways. Here's to summer memories, unexpected rewards, and the great school pool heist.

You’ll Always Own The Beasts

Your clients will always own the beasts and won't need to worry about guessing which companies will come out on top. This approach allows us to benefit from the growth of these giants without the stress and uncertainty of trying to pick individual winners.

Silver Bullets

The more bullets we take, the more impact we have. As behavioural advisers, we are in the bullet-taking business. Our clients’ current selves are hardwired to make poor decisions for their future selves—until we intervene.

Wealth for the Unknowns

As a practising financial adviser, I have built hundreds of financial plans for real families. I’m well aware that these are estimates about people’s futures. We all know that “Man plans and God laughs.”

Simplicity Is Hard To Sell

There are two types of people in the world: simplifiers and complexifiers. You know which one you are. These characters are in a constant battle.

In The Stands

Those on the pitch, by all means, need assistance from many people along the way. Guidance, tips, tricks and ideas. But ultimately, this craft is mastered through working with real people and seeing how financial plans and investment paths develop over time.

Six-Figure Tick Boxes

Stay vigilant for SFTBs; they are lurking everywhere. These seemingly minor decisions can be the difference between a six-figure future and a missed opportunity.

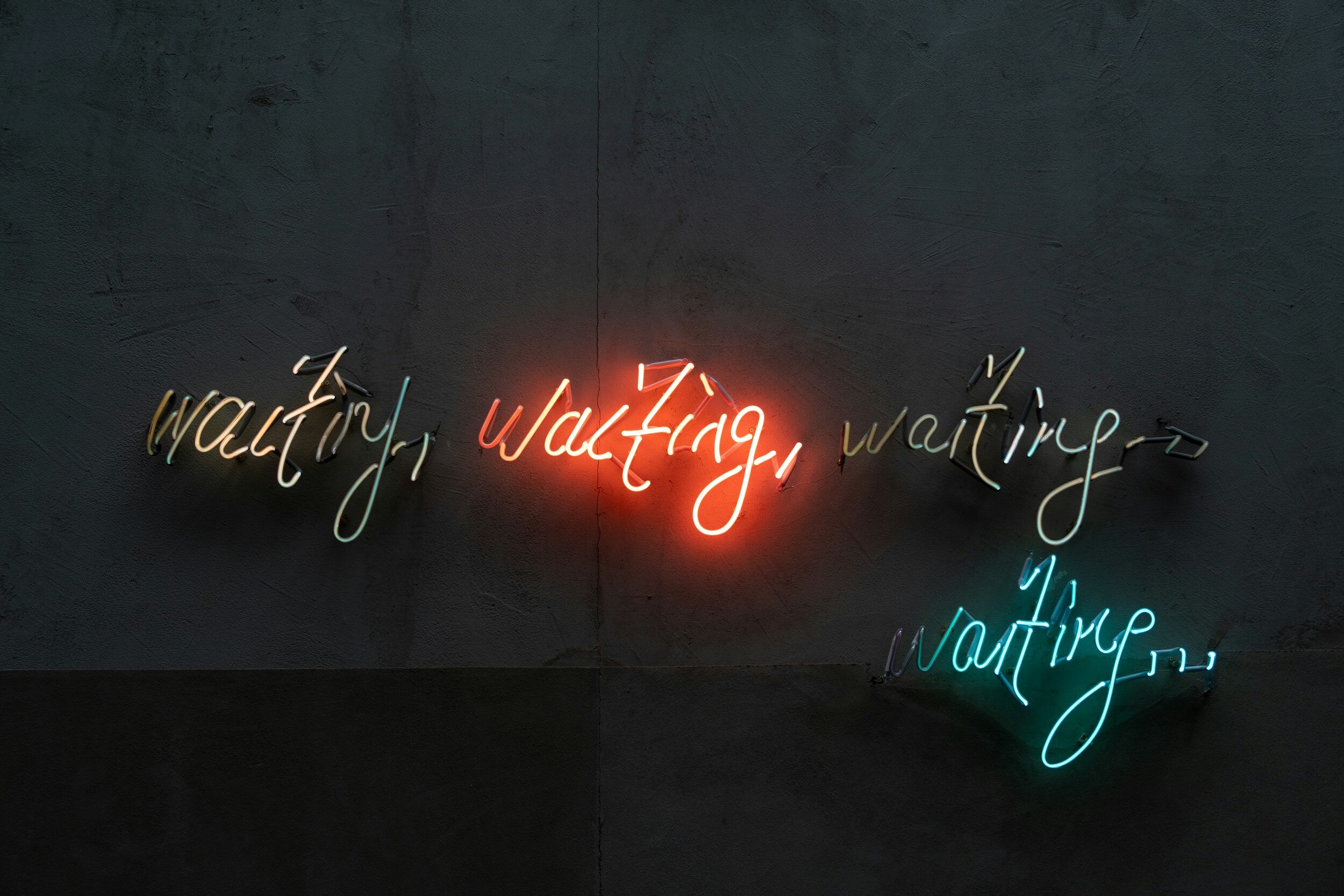

Waiting is Rewarded

How many of your clients can be counted amongst those who stuck to their personalised plan? How many clients switched money they won't need for another two decades into cash when it was offering 5%?

Cheap Gyms

Cheap gyms provide an affordable way for many people to start the long journey to life mastery, which, as we know, has no destination; it’s a continual pursuit.

An Audience of Zero

In the captivating world of glittering success stories, it's easy to overlook the humble beginnings. Every master was once a beginner, and every superstar had moments of doubt, navigating the vast sea of obscurity with no goal other than doing the work. But what does it genuinely take to start something new, and what are the unseen struggles that mark this journey?

The Myth of Wealth Preservation

Every time I hear the phrase "wealth preservation," I can't help but roll my eyes. If I’m being honest, my professional blood boils. Here's why: the investment world is bursting with buzzwords designed to prey on investors' deepest fears while ignoring what they truly need.

Sideways Markets

You and I know that there’s a chance we’ll never see the market at these levels again. Stand firm by proclaiming your core values to those who have entrusted you with their financial future. This is a time to double down on our core values.

Think Hard: Embracing Technology and the Human Connection in the Financial Advising Landscape

As financial advisers, we find ourselves in the unenviable position of selling the invisible. This concept is not exclusive to our esteemed profession but is a common thread in today's service economy in which professionals earn their livelihoods through providing intangible services.

Thriving and not Surviving

Most clients seek advice around the time they wake up, petrified that they will run out of money in retirement. Yesterday, they might have been endlessly scrolling through vacation deals or considering an upgrade to their barely-used car. Today, they're sitting across from an adviser, fearful of running out of money during retirement.