October 2021

Asset Mis-allocation

As professional advisers, we know how important asset allocation is to long term investment returns. A client without a proper understanding of what risk is and what it isn't, doesn't know this. By getting this wrong, clients are destroying more of their own wealth than fees ever will. Why is this not talked about more?

I believe that when it comes to wealth destruction, the guns are pointing in the wrong direction. Instead of pointing at our fees, they should be pointing at asset mis-allocation.

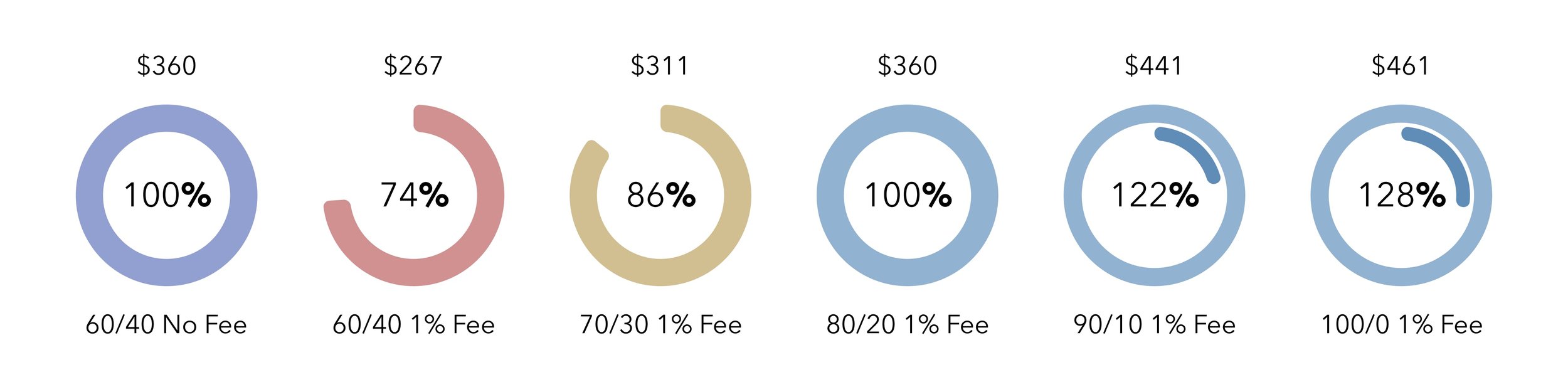

Running the numbers on the most recent 30 year investing period, it was interesting to see that the extra returns you get from nudging a portfolio's equity allocation up by 20% completely covered a 1% annual fee! Everything else you will ever do for this client will be free!

Almost all great businesses have a "story behind the story", their secret sauce as it were. The Urban Massage app has made inroads into the luxury spa industry by providing a win-win-win for the masseuse, the business, and the customer. But their real secret is that they have increased the wages for the masseuse by 4 times, made possible by not needing to rent expensive premises and invest in bloated equipment. Pepsi famously have a lifetime contract to exclusively supply their drinks at all restaurants in the YUM YUM Brands line. And closer to home, Vanguard have succeeded by having a ruthless focus on investor outcomes, amongst other things enabled by being a mutual company.

I believe our secret sauce, the story behind our story, is the courage to have difficult conversations with our clients and push back at their natural misconceptions around money and investing.

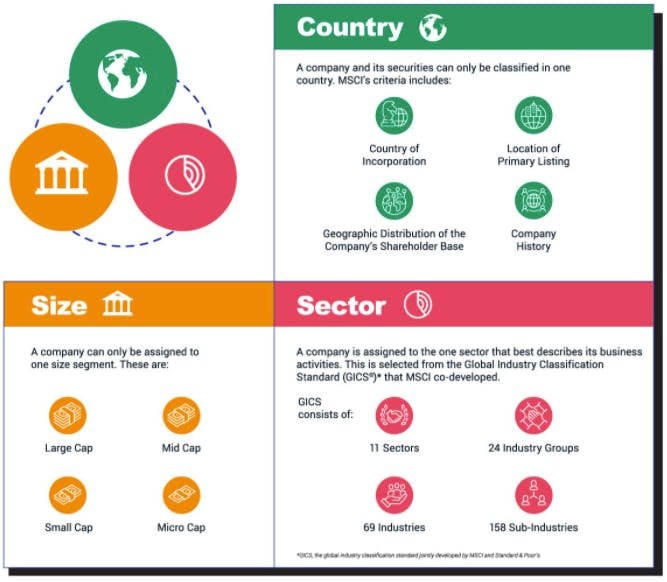

One such conversation is about nudging them away from asset mis-allocation. Our clients need to understand where market returns come from, and it's our job to coach them in becoming investing literates. And yes, they need to understand what volatility risk is, and how we deal with it. This doesn't mean that every client needs a full equity portfolio, the best portfolio is the one you can stick to.

Another difficult conversation is about fees. How we charge and why we charge it. What we provide for that fee, and what the true cost of not working with us might be. We are not wealth destroyers.

Have the difficult conversations early on. Include them in your onboarding process. Do the hard work up front, and you could have an ideal client for life.

Let's not leave this business with regrets. Let's show clients what is possible, rather than them finding out what could have been.

📰 Articles & Blogs

The Broken Clock [6 minutes]. People crave predictions.

This Question Changed Everything [3 minutes]. Tell me more about that...

Taking The Uncomfortable Leap To Create Hockey-Stick Growth [20 minutes]. Different results require different thinking.

Maybe You Should Stop Selling "Service" [6 minutes]. Relationships matter a lot more than a service promise.

Communicate Your Value As An Advisor By Explaining The “How” [16 minutes]. Do you explain the process you follow to implement your services?

Don’t ask clients for ideas. Do this instead. [3 minutes]. It’s easier to say what you think of an idea than it is to have the idea in the first place.

Creating Your Advantage [4 minutes]. Great businesses think through every single step in their customer journey.

🎧 Podcasts

Evidence-Based Methods To Seamlessly Convert Prospects Into Clients with Dan Solin [71 minutes]. The science behind why it's so powerful to get someone to talk about themselves.

Systematizing How To 'Deliver Massive Value' To Charge What You're Really Worth with Matthew Jarvis [93 minutes]. Matthew explains how systems have played a big part in his firm’s growth, allowing him to deliver more value to clients while raising his fees accordingly.

📚 Book Recommendations

Delivering Massive Value: The Financial Advisor's Guide to a Highly Profitable, Hyper-Efficient Practice by Matthew Jarvis. The exact strategies, techniques, tools, and scripts Matthew used to build (and then double) his own practice.

🍿 Videos

Gizelle Willows: The Limitations of Risk Questionnaires

Delivered at the recent HUM South Africa 2021, this talk gives fascinating insights into the different risk profiles available.

👏 Encore

How Life Changes Affect Client Behavior [10 minutes]

Why do clients complain about good advisers? [15 minutes]

The 13 Most Important Marketing KPIs for Financial Advisors [5 minutes]

Giving financial advice - 3 important steps [4 minutes]

100 Simple Truths [5 minutes]