August 2021

Fine Margins and Deep Pockets

Two of the biggest sporting events this Summer were the Tokyo Olympics and the British & Irish Lions rugby tour of South Africa. Both provided lessons about what leads to success in the professional sports era, and perhaps these link to what it takes to be a successful lifetime investor.

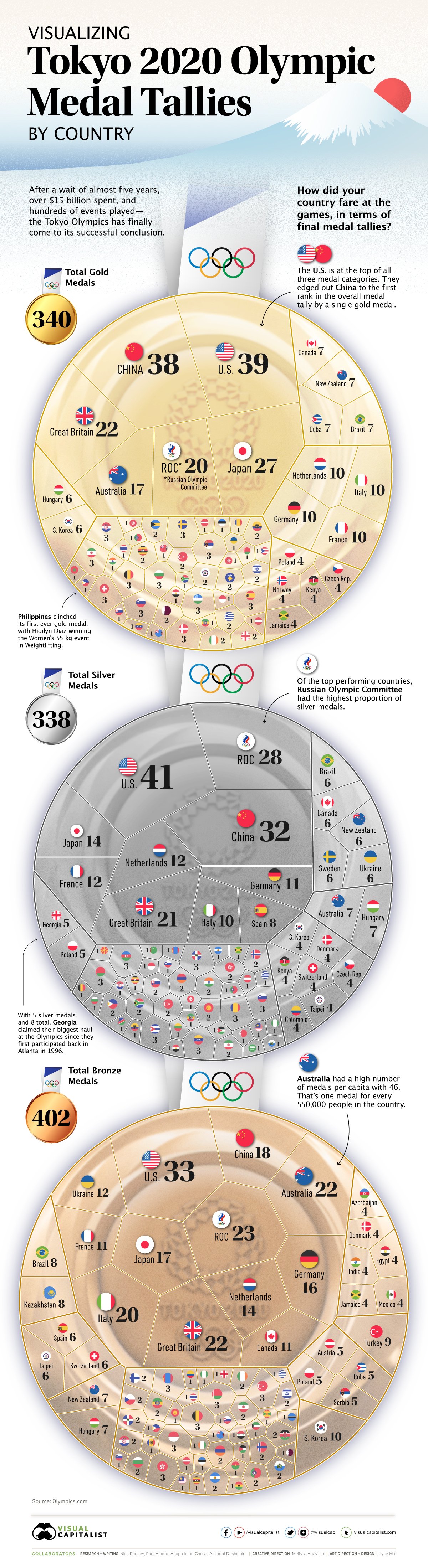

At the 1996 Atlanta Games, team GB won only a single Gold medal and they ended 36th on the rankings table. At the recent Tokyo Games they won 22 Golds and ended 4th in the standings. What changed during these 25 years? The most substantial factor must surely be the formation of UK Sport's World Class Programme in 1997. As the beneficiary of funding from the National Lottery, it has been able to provide all the resources the athletes need to perform at the top of their game. This has led to 117 Gold medals since Atlanta, an extraordinary effort.

Money doesn’t just buy you happiness, money buys you gold medals

This creative funding mechanism has provided over £1.2 billion to aspiring athletes since 1997. It makes sense that the planning, coaching, guidance, and other resources provided created an environment in which athletes could perform at a world-class level. Team GB had deep pockets, but they also deployed this money in a sensible way. In contrast, many athletes from lesser resourced countries are left to their own devices in preparing and paying for the Olympics. This points to the power of planning ahead and the benefit of having the right support people involved. In the same way, we've personally seen the outcomes when clients are committed to planning for their futures and are prepared to pay for the guidance and advice of professionals who put them first.

The second event highlights another lesson. The Lions tour of South Africa saw two world-class teams go head to head. Both had professional players, support staff, and significant funding. This situation became one in which neither team could afford to make mistakes, knowing the other team would be ready to land a knock-out blow. The series was not going to be won by playing exciting rugby, it was going to be won by the team making the fewest mistakes, almost the definition of the great book by Charles D Ellis, Winning the Loser's Game (this book focused on tennis, but the point remains). The margins were fine, as the result showed.

Thinking of our clients, we know that once they do have a plan in place and a behavioural financial adviser helping them, the success of their aspirations come down to how few behavioural mistakes they make. Resisting the urge to speculate in exciting investments, staying invested when markets are down, continuing to invest monthly contributions during the stock market sale, and keeping their eye on the prize, we know long-term investing is also about winning the loser's game.

Sport is fun and a nice distraction from the seriousness of life, but there are lessons in everything.

📰 Articles & Blogs

Go Big, Then Stop [8 minutes]. Compounding money is easier than saving money.

Abandon Your Agenda [4 minutes]. Always go second.

Are You Asking Clients the Right Questions at the Right Time? [3 minutes]. The power of a great question is not only in the asking, but the timing.

Understanding your client’s world – key number 1 [3 minutes]. The most powerful way to listen is with nothing on your mind.

Best Practices In Scaling The Delivery Of Financial Advice [15 minutes]. Adviser efficiency is driven by who the adviser chooses to serve, the expertise they bring to the table, and how they leverage their time.

The stuff they don't teach you in books [9 minutes]. These unwritten things are the key to everything.

Three-Question Survey You Must Send to All Prospects [5 minutes]. A three-question survey to send before every prospect meeting.

🎧 Podcasts

The Behavioral Coaching Dilemma: Giving Clients What They Want Instead of What They Need [31 minutes]. Studies also show that over 80% of advisors DON'T actively promote the behavioural value of advice to prospects or clients.

Scripting A "Values-Based Financial Planning" Business Development Process with Bill Bachrach [109 minutes]. What’s important about money to you?

📚 Book Recommendations

Everything Is F*cked: A Book About Hope by Mark Manson. A counterintuitive romp through the pain in our hearts and the stress of our soul.

👏 Encore

When Less Is More [8 minutes]

3 Marketing Approaches To Maximize Firm Growth [29 minutes]

The Big Problem With ‘Risk Tolerance’ [3 minutes]

To Build a Thriving Niche Practice, Learn When to Say No [3 minutes]

Most Advisors Are Terrible at Niche Marketing [3 minutes]