May 2020

We've had a whole month to settle into what may be the "new normal" for the foreseeable future.

We hope you have used this time to re-energise, draw strength from the incredible value you provide to the families in your trust, and to create new forms of value for them.

Remember This Crisis

We may still be in the middle of what may prove to be a once-in-a-lifetime event for modern society. We'd like to suggest that it's a worthwhile exercise to take stock during this time. The passing of time causes memories to fade. Any learnings from the current crisis are worth writing down. They'll stand you in good stead when, not if, the next crisis comes along.

A market crisis helps to strengthen our proposition as behavioural advisers. It strengthens it not only in the minds of our clients, but more importantly in our own. If you don't believe in your value, no one else will.

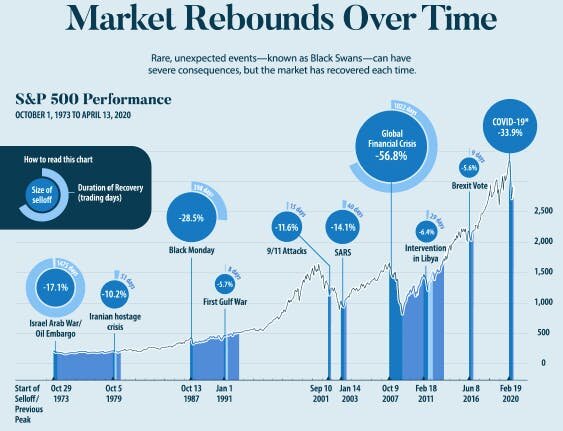

Clients (not yours, obviously) who sold out at the market bottom in mid-March have already lost out on a market rally which they may never recover from.

Those clients who stood firm (thanks to your caring guidance) have financial plans ready to fight another day and portfolio's (mostly) intact.

Every crisis brings with it the moment when the thought, "Maybe it's different this time?", enters the mind. In your lifetime as a behavioural adviser you may need to answer that question for yourself 5 to 10 times.

If you answered it correctly, and more importantly confidently, last month, well done. If you were in any doubt, this current crisis should have confirmed that the determinant factor in financial success is one's behaviour, how one acts but more importantly how one stands strong in the face of uncertainty.

Main Feature

Behavioural planning has greatest impact on clients [3 minutes]

A recent survey shows that what you already take for granted (that behavioural financial planning is the dominant determinant of real-life long term returns) is slowly becoming accepted wisdom amongst advisers. This is great news for clients who for too long have been told convenient lies about the factors affecting their long-term welfare.

Do you follow a planning-led rather than investment-led approach?

The times they are a-changin'.

Articles & Blogs

Top Ten Behavioral Biases, Illustrated #6: The Map is Not the Territory (the Narrative Fallacy) [8 minutes]. We prefer stories to the truth.

Client confidence and the Stockdale paradox [3 minutes]. Faith in the future must be balanced with the reality of the current situation.

Marketing During Covid-19 [2 minutes]. Be helpful and empathetic.

That Call [3 minutes]. Disarm emotions to appeal to rationality.

Why We Doubt Ourselves [14 minutes]. It comes with the territory of any worthwhile endeavour.

What’s Different This Time [4 minutes]. What was a tragic but expected part of life 100 years ago is now a tragic and inconceivable part of life in 2020.

Worldviews Are Pessimistic Because They Are Outdated [5 minutes]. Across the board, in almost every way we can measure it, life is becoming better everywhere.

Confessions Of A Market Crash Novice [3 minutes]. Compassion and empathy – not just investment performance – make you worth your fee.

Meir Statman on Coronavirus, Behavioral Finance: The Second Generation, and More [10 minutes]. The second-generation of behavioural finance describes people as “normal,” neither “rational” nor “irrational.”

How to Master the First 90 Days of The New Client Journey [4 minutes]. Your job is to make sure your clients’ initial experience with you is seamless and repeatable.

Positioning yourself as a behavioral coach [7 minutes]. How do we bridge the gap between what clients are looking for and what research shows is the biggest value added?

Dangers, Opportunities and Strengths [7 minutes]. Most clients lack confidence, their fears have been unaddressed, and they're not excited about their future.

Podcasts

Warren Buffett joins Influencers with Andy Serwer (2020 Shareholders Meeting Preview) [48 minutes] and (HIGHLIGHTS) Berkshire Hathaway 2020 Annual Shareholders Meeting [36 minutes]. The Oracle of Omaha shares his thoughts on the curent crisis. On the eve of turning 90, he has seen it all before.

Coaching Clients Through Uncertainty [70 minutes]. Be proactive.

Morgan Housel – The Psychology of Money [47 minutes]. Money is the "last taboo".

Book Recommendations

The Undoing Project by Michael Lewis. The story of a strained friendship that produced so much.

The Advisor Century: Value Creation in an Entrepreneurial Society by Dan Sullivan. Written 8 years ago, Sullivan lays out a blueprint for value creation.

Other

Hartford Funds: Value-Add Resources. This site is a treasure trove of client-friendly documents.

Encore

Sam Sloma’s Thoughts On Fixed Fees, Technology & Positivity Today [4 minutes]

Adjusting Your Value Wheel [2 minutes]

Why we're getting Zoom fatigue [3 minutes]

Client Note-Taking: How Advisors Can Improve Conversations [20 minutes]

8 Ways to Get Prospects to Switch Advisors [8 minutes]

The Ideal Home Videoconferencing Setup For Client Meetings [20 minutes]

10 predictions for financial advisers in a post-crisis world [5 minutes]

Wade Pfau: Coronavirus Tears Up 4% Retirement Rule [7 minutes]