June 2022

A monthly newsletter of the best behavioural resources from around the web. Enter your details below to start receiving our regular updates.

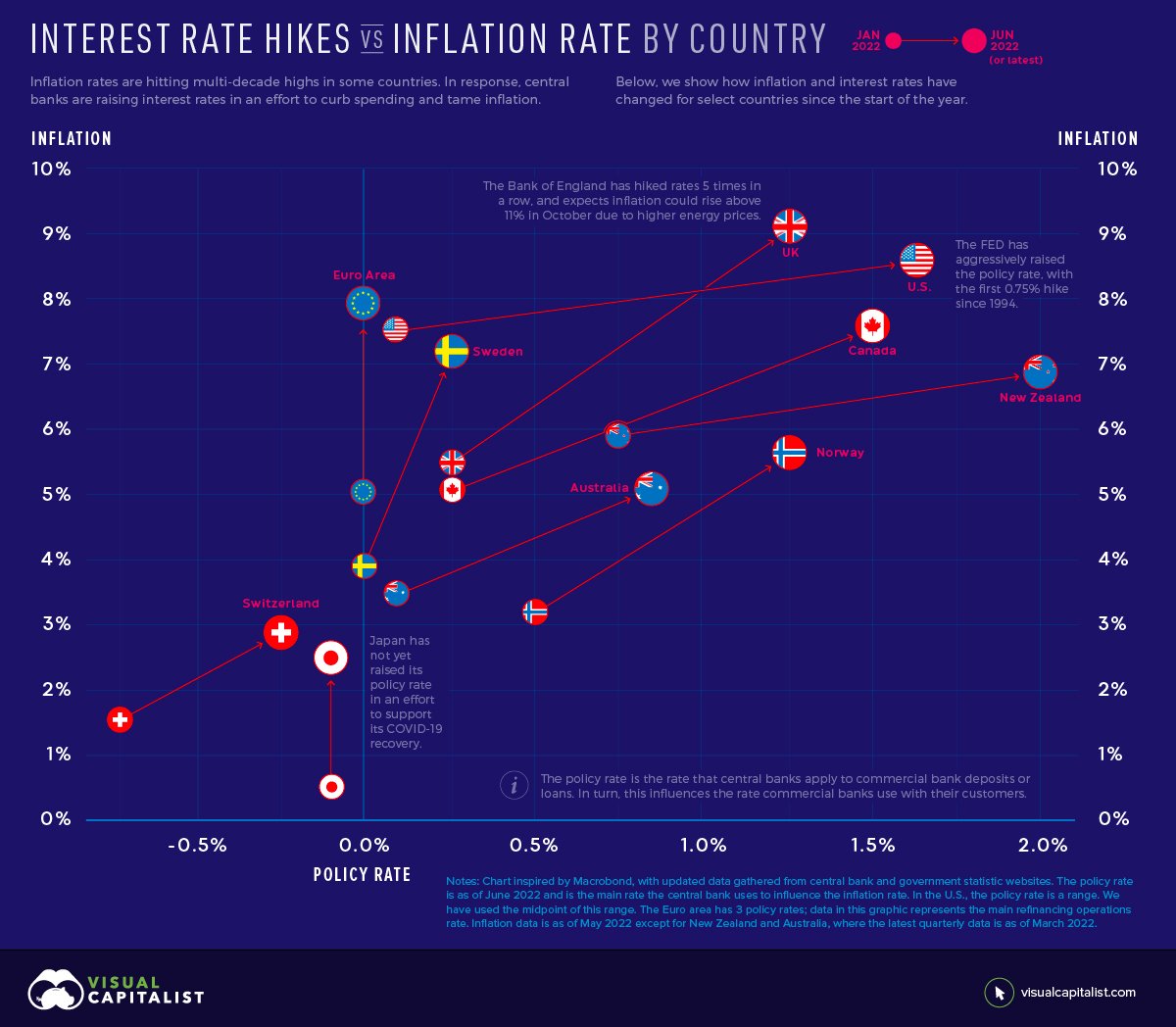

The marvellous stock market sale is still in full bloom (maybe, maybe coming to an end). I hope you're framing this accordingly with your client families. During these times I do reflect on how my coaching has prepared my clients for such times. The clients that cannot stomach such declines usually make it clear by banging on your office door, usually in the form of sending an email grenade (such an act requires no effort). A 5-second email can all of a sudden be a major issue for you to deal with. I have favoured phone calls following on from any 'serious' emails from a client.

I think the easiest go-to rule-of-thumb is that on average the markets are advancing approximately 75% of the time and declining the other 25%. However, we don't know the sequence in advance. Also, it's highly likely that once you become a client the markets start to decline - you have to lead with this otherwise you're not telling your new clients the truth about their money. All they should ever get from a behavioural adviser is the unvarnished truth. No pandering, ever. We don't do that here.

An Intentional Welcome To Reduce Buyer’s Remorse

The amount of good we do for new clients can be substantial.

Our perfect clients are open to our advice, keen to act, and quick to sign any paperwork. What this means is that during the first three months a lot can change in the financial lives of the families who choose to work with us.

This does open the possibility for them to be uncertain about where accounts and monies have been moved to. To reduce their anxiety and hesitance I have implemented an additional meeting in my take-on process. Some of you are already doing this (your advice would be appreciated, hit reply) while others may want to consider doing something similar.

The Welcome Meeting

The Welcome Meeting provides an opportunity for everyone to review and reflect on what's been done. We go over what changes have been made, reminding them of why it was done and why they're now in a better place.

It also sets the scene for how we will work together from this point. The amount that we do and the potential changes going forward are likely to be substantially less and I like them to have realistic expectations of how we will engage from this point on.

What should they expect from me? What do I expect of them? When will we meet? How can they contact me (when is text good, when should they use email)?

So much of our work involves setting expectations, we really can't be too careful with this aspect of the relationship. While going into detail may surface a difficult conversation, I'd prefer to have it now than have the issue repeatedly come up in the future.

The First 12 Months

A key part of this meeting is explaining the importance of our first 12 months together. Although I have this set out in a document that's already been sent to them (now available to HUM Premium members), I believe it's important to verbalise. Let them see the confidence you have in the process you follow.

One of the major challenges in the first 12 months is that there's a good chance we could experience a temporary decline in their portfolio values. Will they see this as a failure of your advice and process? Having a discussion about this upfront reduces the chance of that happening.

They need to understand that any portfolio changes made do not mean they should change the "starting value" of their portfolio in their minds. We've merely changed the make-up of the portfolio, for good reasons. They may still be up 200% over their lifetime, and temporary declines will occur regularly on their investment journey.

More Work Now, Less Stress Later

Considering all the benefits of having this catch-up meeting, I think the extra work is well worth the effort. Transparency in everything we do increases trust in us (and our profession) and reduces client anxiety.

We know we're doing good work with and for them, any buyer's remorse on their part would be a shame.

Do you have other ways you've found helpful in enhancing your client experience to increase trust, reduce anxiety, and create clarity? Let me know!

📰 Articles & Blogs

Timeless Lessons From the 2020-2022 Cycle [5 minutes]. Investing right now seems harder than usual but maybe that’s always the case.

Why volatility isn’t the risk which should worry you [6 minutes]. The unfortunate obsession about standard deviation.

Underspending in Retirement: A Sign of Fulfillment or Fear? [5 minutes]. Making the shift from saving to spending can be difficult.

Too Many Clients [8 minutes]. The depth of your relationship starts slipping at a certain number of connections.

Discover one of the best financial planning questions [3 minutes]. Make it easier to talk about things that are subjective, such as feelings, opinions, and beliefs.

The One Behavioral Finance Truth All Firm Owners Should Know [6 minutes]. Every dream has a price.

🎧 Podcasts

Berkshire Hathaway: The Incomparable Compounder [74 minutes]. A breakdown of the business run by the most famous investors of our time.

Balancing Optimal Advice With Recommendations That Clients Will Actually Implement [37 minutes]. Maybe done is better than perfect?

📚 Book Recommendations

Things That Matter: Overcoming Distraction to Pursue a More Meaningful Life by Joshua Becker. A book that helps you identify the obstacles that keep you from living with intention, and then provides practical ideas for letting go of those distractions today so you can focus on what matters most.

👏 Encore

2022 Must-Read List Of Best Books For Financial Advisors [28 minutes]

Nine Steps to Launch a New Niche [5 minutes]

How Using Visualizations Can Improve Client Communication [19 minutes]