January 2022

The Inevitable Return of Volatility

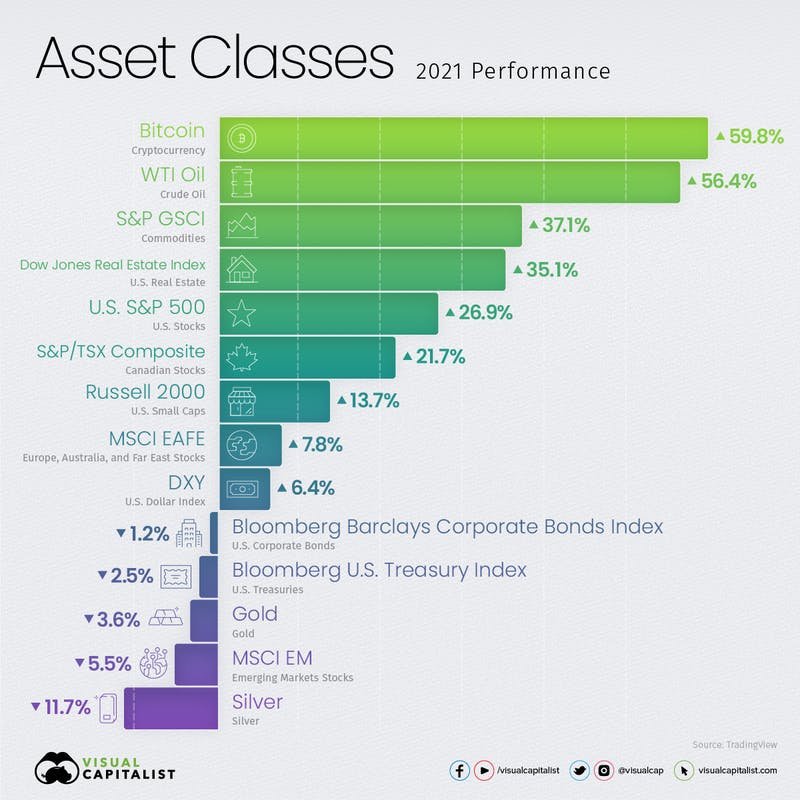

With a drawdown of only 5% in the world’s premier index, the S&P500, 2021 conveyed the message that market returns are easy to come by with minimal downside movements.

However, as you and I know, one cannot have market returns without enduring volatility. The danger is that our clients have forgotten this.

So, as we prepare for the year ahead we need to make sure we don’t become complacent in preparing our clients for the inevitable return of “temporary market declines”.

It’s hardly going out on a limb to predict that this year will see the return of more substantial volatility. Bring it on I say, the behavioural adviser shines during the tough times.

With increased inflation now a reality in the developed world, fresh concerns about geopolitical conflict, and midterm elections in the US, the possible triggers for market volatility are many.

Already we have seen a deep decline in January, wiping out a large portion of last year’s gains. This has unfortunately surprised a few “investors”. But this is what the market does and will continue to do.

Before we can be useful to our clients, we first need to internalize the truths of market corrections. We need to understand how they fit into the arc of market history so that we can simply and effectively coach clients to see these events for what they are, an opportunity to “earn” the returns that come from behaving like a grown-up during uncertain times.

Knowing that it’s not “different this time” is a prerequisite for explaining to a distressed client why “losing” a few years of retirement income is not something they should be concerned about. And of course, for our clients who are still saving, a decline is a gift from heaven! You are buying units at knockdown prices.

Best of all is being able to demonstrate with a robust cash flow planning tool that their lifetime plan succeeds in spite of the current declines.

Do you (and your clients) understand the average intra-year decline, the frequency of bear markets, the proportion of positive return years, and the probability of capital loss over different periods?

While this data is important and can be useful in explaining core concepts, what they need more than all of this is you. They need you to be confident in what you believe and what you’re advising them to do. The messenger is the message, as they say. We are the last line of defense.

Are you ready to be the adviser they deserve?

📰 Articles & Blogs

What is the most important financial planning question of all? [3 minutes]. How much better is your client’s life NOW?

3 Essential Client Meeting Skills For Financial Advisors [26 minutes]. Anyone can master these.

Charts of the Year [6 minutes]. Lots of interesting market statistics in here.

I Think You Should Charge More [6 minutes]. Stop trying to discount your way to success.

Just 5 Years Can Change Your Life [6 minutes]. Do you have the business you want?

How to Use This Powerful Listening Magic Trick [4 minutes]. Simple but not easy.

Fearless Forecasts for 2022 [10 minutes]. 9 Industry forecasts for 2022 by industry veteran Bob Veres.

A tale of two advisers, and why boldness wins [4 minutes]. Are you too afraid to stand out?

🎧 Podcasts

Virtual Or In-Person Meetings: What Do Clients Really Want? [29 minutes]. Where do you stand on this issue?

📚 Book Recommendations

How to Change: The Science of Getting from Where You Are to Where You Want to Be by Katy Milkman. A groundbreaking blueprint to help you to achieve personal and professional goals

👏 Encore

Big Skills [2 minutes]

5 Design Tips To Boost Trust And Credibility On Your Website [27 minutes]

What Is Web3 and Why Should You Care? [4 minutes]

Hugging the X-Axis [13 minutes]