January 2024

A monthly newsletter of the best behavioural resources from around the web. Enter your details below to start receiving our regular updates.

Six-Figure Tick Boxes

Imagine the year is 1986, and you and your best friend, Charlie, have just secured positions at a renowned retailer. Brimming with enthusiasm, you arrive early, impeccably dressed in your company uniform, eager to conquer the world. Following some formal training and the issuance of name badges, you're summoned to the back office to meet with the company pension adviser.

A tinge of apprehension fills the air as you both wonder what this meeting is all about. Your family has always harboured a somewhat negative sentiment towards pensions, while Charlie's family has been more optimistic. The adviser presents a straightforward pension plan—contribute 2% of your wages, and the company will match it with 10%.

Due to your preconceived notions that pensions are unfavourable, a mindset inherited from your family, you decline politely. Charlie, viewing things from a different perspective, decides to join and confidently 'ticks' the box. That simple tick will pave the way for a six-figure future for Charlie—an embodiment of what we call 'Six-Figure Tick Boxes' (SFTBs).

In the realm of personal finance and investing, I often witness numerous instances of SFTBs in action. Take default funds, for example. Many individuals, when joining company pension schemes or other investment plans, often default to the predetermined fund. These default funds typically invest in asset classes that stifle wealth creation over extended periods, being optimised instead to dampen short-term volatility. Opting for a fund exclusively focused on global equities, the world's premier wealth creation engine, can yield results that differ night and day over multiple decades. So we have another SFTB: steer clear of default funds. Unfortunately, without your guidance, clients might find themselves stuck in suboptimal investments.

Another SFTB involves the widespread practice of 'lifestyling' in pension plans leading up to retirement. This outdated strategy, likely conceived by investment novices or committees, involves shifting assets from high-returning assets (global equities) to lower-return ones (fixed income and cash) before retirement. This practice was created at a time when people were forced to buy a pension annuity, so ideally, they wanted to ‘protect’ the value in currency terms leading up to their retirement date. Many clients subjected to 'lifestyling' are unaware of its impact on their wealth. Choosing whether to 'lifestyle' or not becomes another SFTB—tick the right box, and you're looking at a six-figure difference down the line.

Another SFTB surfaces during discussions about investment contributions. I consistently advocate for clients to make sound financial decisions for their future selves, urging them to increase contributions frequently and aggressively. In meetings, I engage in a bit of mental gymnastics to help them grasp the concept of SFTBs—agree to a monthly increase, and you're paving the way for significant wealth in the future. Most clients tend to underinvest, and when they achieve financial freedom down the road, they'll be grateful for these nudges.

Encountering SFTBs is a regular occurrence with my real clients, and I'm steadfast in ensuring the right choices are made with full comprehension of the implications.

Stay vigilant for SFTBs; they are lurking everywhere. These seemingly minor decisions can be the difference between a six-figure future and a missed opportunity.

📰 Articles & Blogs

Implementation Questions For Consistent Follow-Through [21 minutes]. Are you struggling to get your clients to take action on your recommendations?

Rich People Don't Talk to Robots [11 minutes]. Do you fear AI-driven advice?

Why?: "Are Advisors Becoming Life Coaches?" [7 minutes]. This shift is transforming the world of financial advice.

Work That Matters Is Difficult [5 minutes]. Strategies to overcome the hidden challenges of pursuing meaningful work.

The Thirty Second Mind [6 minutes]. How to gain an unfair advantage in today's distracted world.

'Magic Wand' Questions To Help Clients Articulate Financial Goals [18 minutes]. How to help clients envision a brighter financial future.

🎧 Podcasts

TRAP 37 - Always Be Learning [84 minutes]. The TRAP pack discusses personal development.

Retiring Retirement Income Myths with the Retirement Income Dream Team [73 minutes]. Debunking misconceptions and expert insights into an important topic.

📚 Book Recommendations

Clear Thinking: Turning Ordinary Moments into Extraordinary Results by Shane Parrish. A guide for how to see the world clearly.

👏 Encore

What Future Clients Really Want [10 minutes]

Direct questions worth answering [1 minute]

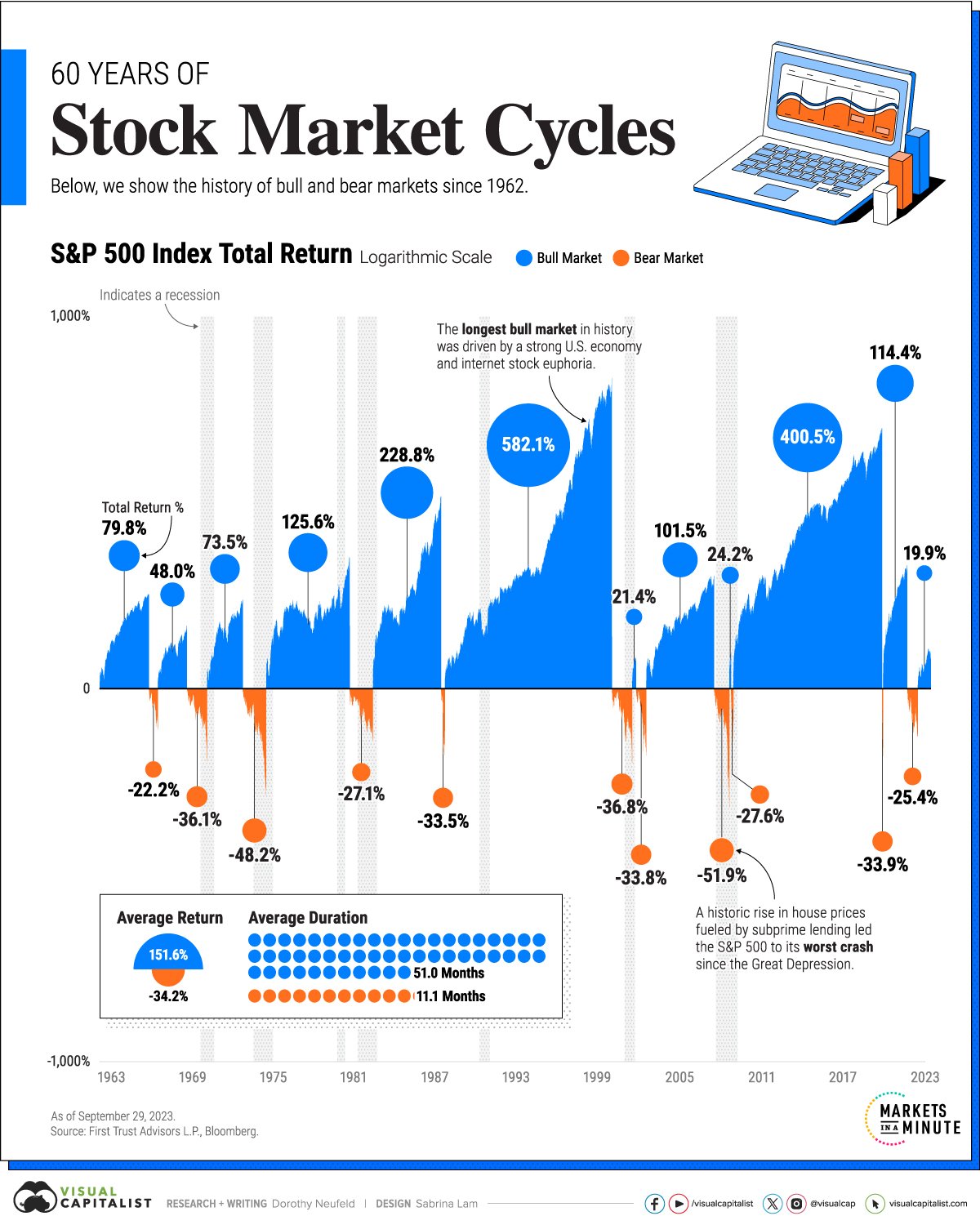

Stock Market History Illuminated, 2023 Style [4 minutes]

"Custom GPTs": Advanced ChatGPT AI Integration For Advisors [22 minutes]

Mental Models: The Best Way to Make Intelligent Decisions (~100 Models Explained) [34 minutes]