February 2021

Rational Optimism

One of the clearest indicators of whether a prospect has the potential to become a successful lifetime investor (a financial literate, as I like to call them) is whether they are a natural optimist or pessimist.

Optimists are nicer to be around, will go through life happier, and most importantly the evidence is on their side.

Since we've started keeping records, we have seen nothing but improvements in the important metrics of life expectancy, child mortality, poverty, literacy, and clean water.

Data and charts for the above, and many more, are available at https://ourworldindata.org.

The world we live in is infinitely better than the world our grandparents experienced. Does this mean that there's nothing wrong in the world? Of course not - some things can both be bad and be getting better.

So why are we always surrounded by bad news? Good things happen slowly over time, while bad things happen suddenly and are therefore "news". Secondly, our brains are programmed to look for danger, this is how we survived on the Savannah. As Daniel Kahneman discovered, we feel loss much more acutely than we experience gains of a similar magnitude (the beast that we now call loss aversion).

The Danger of Being a Pessimist

Those who see the glass as half empty are destined to become poor investors. By focusing on the negative, they prevent themselves from considering the long-term, an essential requirement for the discipline and patience required to be a successful investor.

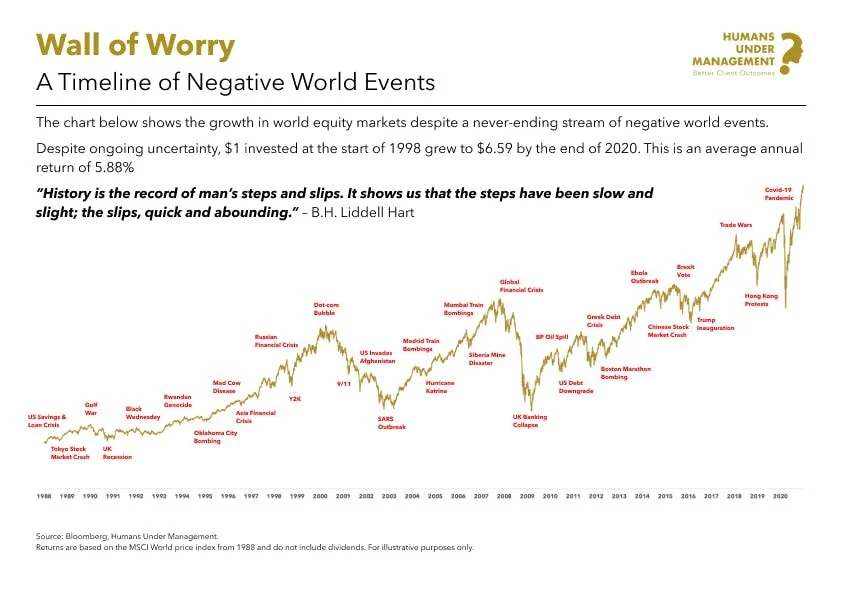

They lack the ability to see beyond the current crisis, always waiting for the certainty that never comes. Their demand for certainty has come at a great cost. As can be seen in the chart below, global equity markets have risen steadily despite a barrage of negative world events.

As Nick Murray says:

'The average client makes 30 year investment decisions based on the last 30 minutes of news'

A Better Way

How do we protect ourselves, and our clients, from the negativity around us? Here are a few ideas:

1. Be intentional about media you expose yourself to. Is it really necessary to consume "breaking news"?

2. Study market history. You'll discover that past gains have been in spite of negative events.

3. Remember that markets are forward-looking. Past events have been priced in already.

4. Marvel at human ingenuity. Even in the current crisis we've outdone ourselves. Notwithstanding the devastation it has caused, the progress that'll come from this, I believe, will be unprecedented.

📰 Articles & Blogs

There's no such thing as a local advisor anymore [4 minutes]. Clients want the best, not the nearest.

The 5 Paradoxes of Planning [4 minutes]. Good insights into the world of financial planning.

Unfortunate Investing Traits [8 minutes]. 5 Traits that prevent investors from doing the average (but good enough) thing.

10 Investing Lessons from 2020 [5 minutes]. to the point and supported by charts.

A Monte Carlo 50% Retirement Success Probability Can Work [30 minutes]. Regular reviews and course corrections are your friend.

Rethinking If (or How) You Use Social Media [5 minutes]. Share valuable content and let them see the real you.

The Behavioral Ingenuity of Dave Ramsey’s Advice [30 minutes]. Taking action beats the perfect plan.

10 Insights From 10 Financial Charts [3 minutes]. The power of compounding returns in action.

🎧 Podcasts

The Easiest Person to Fool [53 minutes]. When last did you change your mind?

William Bengen: The 5% Rule for Retirement Spending [38 minutes]. New research from the Godfather of retirement withdrawals.

The Benefits of Social Media for Financial Advisors [20 minutes]. 12 Tactics for better using social media.

📚 Book Recommendations

Business Made Simple by Donald Miller. Another book full of value from the team that put out Building a Storybrand.

🍿 Videos

Paul Cleworth: Our What, Why & How

Watch this masterclass in client engagement from Paul Cleworth.

👏 Encore

The most important finance book I’ve read [4 minutes]

3 Important Wealth Sources Advisors Overlook [4 minutes]

Enough [8 minutes]

Talk Less, Listen More [4 minutes]

Why I Stopped Emailing My Clients [3 minutes]

Planning For Gen X/Y Clients: Not Simpler, But Differently Complex [11 minutes]

The Mindset Shifts That Matters [3 minutes]