December 2022

A monthly newsletter of the best behavioural resources from around the web. Enter your details below to start receiving our regular updates.

Fresh Paint

It felt appropriate to end this year with a final essay in tribute to our late great Queen, Elizabeth II. I’m a perfect product of this kingdom. My Dad a Scot (born in Glasgow), my Mum Welsh (born in Merthyr Tydfil), and me? Born in the world’s greatest city, London, and living my life feeling English.

I don’t believe a single human has served their country in such an unforgiving way as “Lilibet” did. Her time as Monarch was unprecedented, her attention to service unrivalled, her impact unsurpassed. We don’t quite appreciate how much influence she had behind the scenes globally. The nuclear bomb has contributed to world peace, but I think The Queen has aided more.

Her life of service was gruelling. I couldn’t think of anything worse. My character is not built for platitudes and pomp. Her intense work schedule meant she might have three or more daily engagements. At these engagements, it was said that all people could comment on was the smell of ‘fresh paint’. The Queen was coming, which meant the place had to look perfect.

Not a pot was out of place, and the walls shined with a lick of fresh paint.

What Do They Smell?

This made me think about what our clients and prospects remark after being with us. What do they smell?

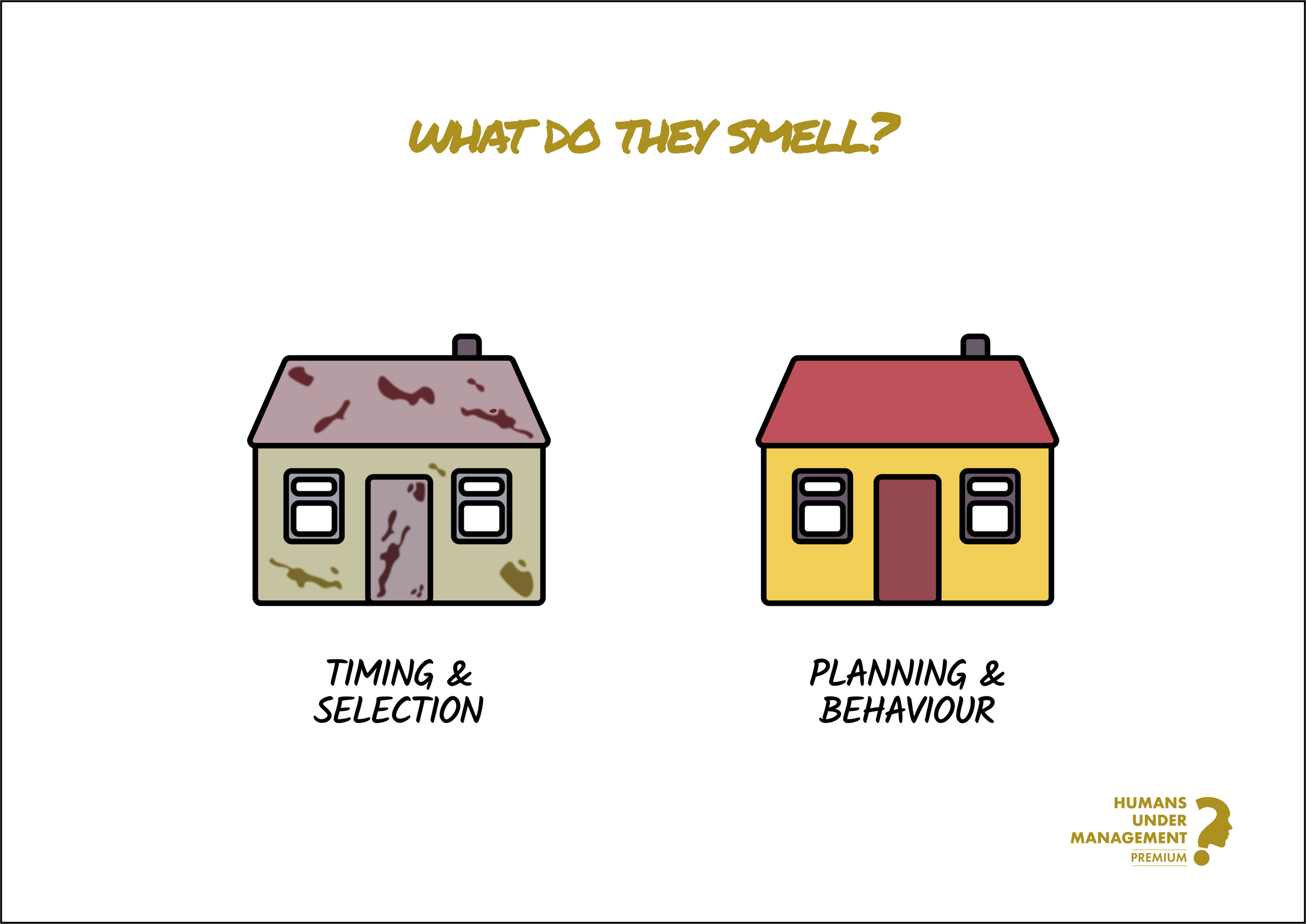

As behavioural financial advisers, we want the interactions with our clients to maintain consistent messages. The message they receive from the financial media is that financial success comes down to market timing and forecasting. In other words, knowing what’s going to work next. In stark contrast, our message is that financial planning and behaviour (or misbehaviour) will dictate your financial success.

The messages are not similar. They’re not even alike; they’re polar opposites. Our message is counter-cultural and, most importantly, counter-intuitive. Essentially, we tell our clients to do the opposite of what they innately feel is correct. It’s a tough job requiring plenty of faith in the future, but it’s a message we must continually dispense to our client families.

The financial adviser’s equivalent of fresh paint for our clients is that behavioural financial planning is the central tenet of what we do. Every time they come near us, they should smell it. We need to ooze it.

Don’t Do That!

After two bear markets in three years, our proposition is as needed as ever. Come back in 2023 refreshed and ready to keep doing your noble work. You’ve saved many families from the financial darkness. The next crisis is around the corner, and the message we preach will stand up to the test as it always does.

I’ll leave you with the three greatest words the financial adviser can say (courtesy of Nick Murray),

“Don’t do that.”

We earn our golden coins during the declines. Speak next year, my fellow financial warriors; you deserve a rest.

📰 Articles & Blogs

101 Ways Financial Advisors Can Add Value For Their Clients [20 minutes]. A useful list for shifting the adviser value conversation.

Ideas That Changed My Life [5 minutes]. A few big ideas drive most of what you believe.

The Gift of Time [3 minutes]. In the end, all of your money will be converted back to time.

If You Try To Do Everything, You Won’t Do Anything [6 minutes]. By improving our systems, we buy ourselves time and energy.

The Riddle of Rest [6 minutes]. Rest is when you’re not associating your self-worth with what you have to do next.

🎧 Podcasts

The Real Adviser Podcast: 7 - What Is REAL Financial Planning? [66 minutes]. Examples of real financial planning and how it transforms people’s lives.

How To Guide Comfortable Conversations That Actually Inspire Change [93 minutes]. The most effective way is to get people to persuade themselves.

📚 Book Recommendations

The Compound Effect by Darren Hardy. An exploration of the core principles that drive success.

👏 Encore

Independent Wealth Advisors Need a Digital Brand Mindset [4 minutes]

Your Annual Letter [5 minutes]

The New Financial Planning Process That Saves Time, Empowers Clients [5 minutes]

How Advisors Can Create An Annual Financial Planning Process [22 minutes]