December 2019

Endowment Effect

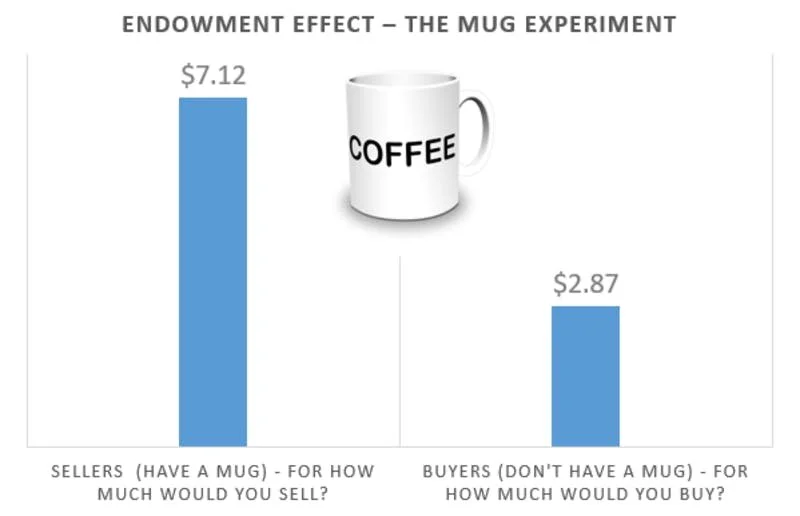

The endowment effect describes the phenomenom of overvaluing something we own, regardless of its objective value. Stated another way, people are more likely to retain an object they own than acquire that same object when they do not own it.

Although this bias has been replicated in many studies (e.g. the coffee mug experiment conducted by Richard Thaler and Daniel Kahneman), we can think of many scenarios where it plays out in real life.

There are many scenarios in which a seller place a significantly higher value on an asset than a buyers does.

Property is an example that comes to mind - the fond memories and emotional value of a family home is not something that is shared or appreciated by the new-to-town buyers.

When it comes to investing, people are often willing to hold onto an investment which they would never buy if they had cash to the same value. The owner is valuing it more because they own it.

Have you seen this demonstrated by your clients?

How could you reframe the situation to help them see that they would value the investment a lot less if they didn't currently own it?

This article demonstrates how this bias is being exploited by various businesses. The endowment effect is yet another example that we aren't rational "econs" but irrational humans.

Main Feature

The Problems With Behavioral Investment Advice [5 minutes].

At HUM, we are very proud of the fact that we are empowering advisers to lead their clients to better outcomes by focusing on the most important factor related to future financial freedom: the client's behaviour.

However, we are very aware that the average investor is not looking for a behavioural financial adviser. In that sense, what the client wants and what the client needs are two different things. This affects the way we market and onboard new clients.

This article brilliantly captures the reasons why clients may not be so eager to intentionally seek out someone to help them improve their behaviour.

Articles and Blogs

The Fourth Rule of Human Risk is... [3 minutes]. To fix the behaviour, fix the environment.

The Best Investment You Can Make [3 minutes]. What's more important than time with family?

Navigating life’s big, non-reversible decisions [2 minutes]. Human stuff. Stuff that can’t be automated. Stuff that often only makes sense after a conversation with another living, breathing human being.

"I Need Behavioral Coaching"...Said No One, Ever [3 minutes]. Ego is the enemy.

Lessons in behavioural change from railway track trespassers [5 minutes]. The subconscious mind is more powerful than the conscious mind.

Don't go with your gut [3 minutes]. Think of one-time scenarios as recurring games.

William Sharpe: How To Secure Lasting Retirement Income [5 minutes]. Helping clients to manage the two sources of uncertainty in retirement.

The power of place [6 minutes]. Your clients’ portfolios are the investment environment that they inhabit.

No More Gurus [3 minutes]. The future is not knowable, and the path forward is not obvious.

Vanguard's Personal Advisor Services — anything but personal [2 minutes]. There's nothing to concern the behavioural financial adviser here.

Podcasts

Blending behavior and fundamentals [53 minutes]. Even investment managers are in on the game.

Take the deal with Daniel Kahneman [43 minutes]. An excellent study of how framing impacts our ability to make good decisions.

Daniel Crosby | Why Financial Advisors Need to Understand Human Behavior to Better Serve Their Clients [75 minutes]. The impact we have on our clients depend on this.

Getting Unstuck And Re-Aligning Fees To Build The Solo Advisory Firm You Want with Tanya Nichols [98 minutes]. The magic power of focus and intention.

Book Recommendations

The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution by Gregory Zuckerman. A captivating holiday read about the greatest moneymaker in modern financial history.

Why We Sleep: The New Science of Sleep and Dreams by Matthew Walker. Most of us don't get enough.

Other

The Vanguard Advisor’s Alpha® guide to proactive behavioral coaching. Learning the “how” of behavioural coaching is completely within your control.

Encore

The Most Popular Wikipedia Pages, From 2007-2019.

Price's Law: Why Only A Few People Generate Half Of The Results [3 minutes]

The Unusual Books That Shaped 50+ Billionaires, Mega-Bestselling Authors, and Other Prodigies [4 minutes]

The new dot com bubble is here: it’s called online advertising [10 minutes]

Why Nobody Is Reading Your RIA’s Newsletter [4 minutes]

10 Attributes of Great Financial Advisors [2 minutes]

Interview with behavioural economist, Koen Smets [4 minutes]