Financial Advice Is A Luxury Product

It’s become popular within the financial advice profession to discuss endlessly how we can take our services downstream, making them accessible to more people who currently can’t access or afford them. In other words, modify our businesses to attract people who have cheap financial questions.

Typically referred to as the “advice gap”, some entrepreneurial advisers have taken it upon themselves to try and serve this segment, an admirable endeavour. However, the idea that quality, personalised, professional financial advice is anywhere close to being able to serve the masses is absurd. Neither the business model, incentives, nor the growth in the number of quality independent advisers suggests that we’re close to such a point.

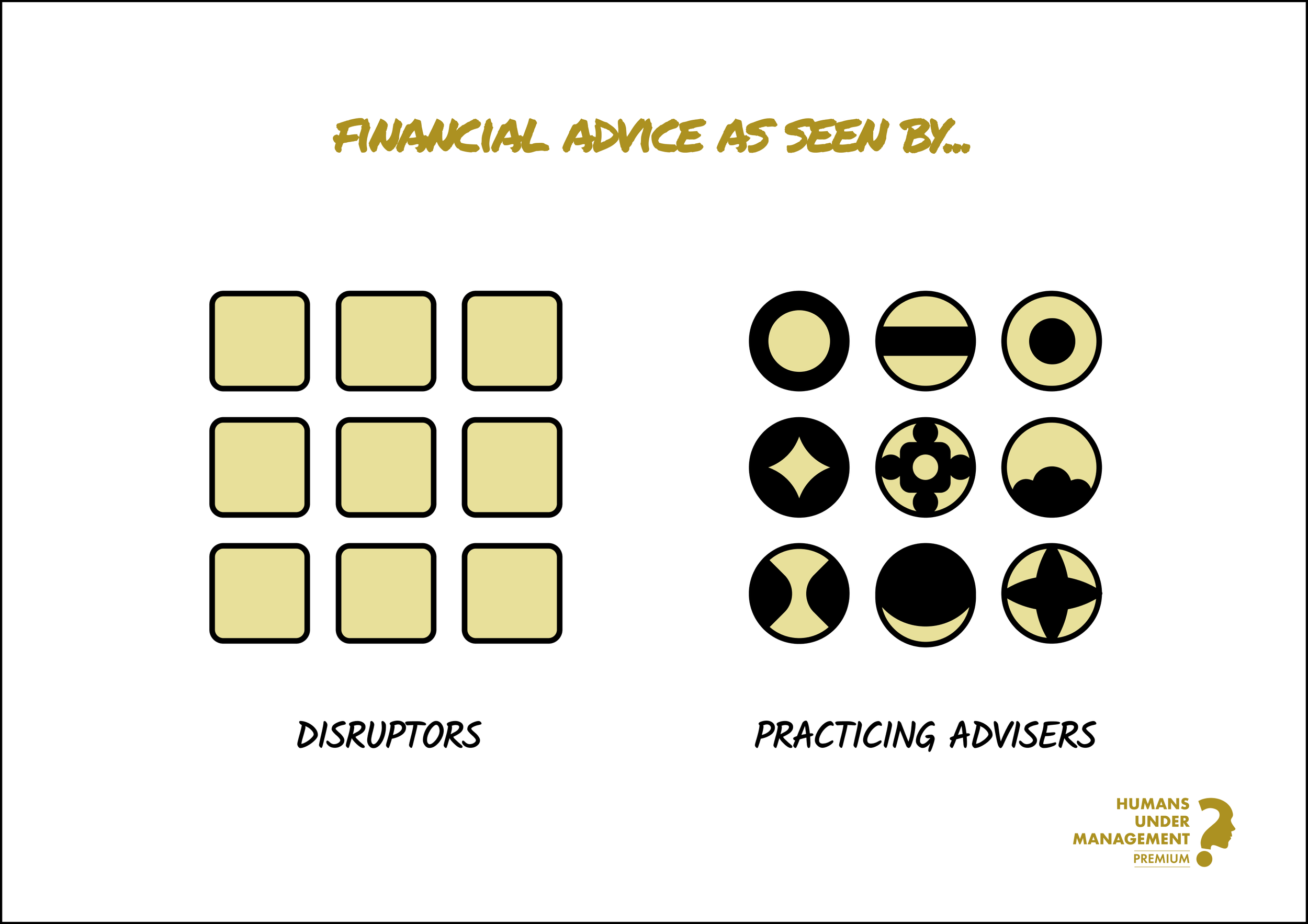

What typically happens is that a start-up will try to commoditise the very personalised service we provide with the aim of offering it more cheaply to more people. Anyone who’s ever sat with a client will know that this is very difficult to do. Unique circumstances and emotions usually result in advice that cannot be programmed into an easy-to-follow recipe.

This usually results in no ‘advice’, with all recommendations being just product recommendations. As we all know, without financial planning, product advice is useless. What starts as a noble endeavour becomes the same business as the ones they tried to replace after all the right lessons are learned. Often, a load of venture capital cash has also been spent. Do we need to go through this cycle again?

It’s hard to get away from the truth: professional financial advice cannot be successfully taken downmarket, and providing it at scale is challenging. New disruptors typically offer their services for a super cheap fee to attract interest and then increase the fees a few years later due to the unsustainable business model.

For this reason, quality advisers will always move upmarket (more wealth, more complexity), resulting in personal financial advice being a luxury product. We answer expensive questions, and that’s why clients seek us out. Can you opt out of this system? Of course, it’s never been easier to choose your niche and build a business you’re proud of. But this doesn’t change the overall landscape of good advisers and firms going where the money is.

There are certainly ways for advisers to help those who cannot access or afford quality advice, such as pro bono work, money guidance and educational media brands. However, the idea that quality professional financial advice can be commoditised and offered cheaply to the masses is unlikely to be successful. Lots of new brands scale because they’re selling pound coins for 80p. On their journey to profitability and maturity, they morph into the behemoths they planned to disrupt and had such a disdain for on launch.

If we agree that competing on price is a fool’s errand, let’s instead pour our focus into increasing the value we provide to those willing and able to pay.

For example, the value of behavioural advice has been clear for a few decades, yet the bulk of advisers still operate as if finding the best product is the pinnacle of financial advice. Let’s use the advancement in technology to become more efficient, serving more clients. Further, let’s use the ability to communicate at scale to regularly educate our clients and prospects about becoming better lifetime investors. This same content can educate those who are not yet in a position to benefit from more personalised advice.

The client families I serve will be told the harsh truths about financial success, including the inconvenient fact that humans, through mistakes at crucial times, are the biggest wealth destroyers. Impactful mistakes are not investing a just-about uncomfortable amount each month and not having the correct asset mix for their long-term invested capital. Dispensing these truths adds real value to client families and can only be administered by a wise behavioural coach whose north star is ‘better client outcomes’.

But above all, I believe that being a behavioural financial adviser will end up being one of this century’s most cherished and fulfilling professions. Do not be distracted by the misplaced ambitions of a few to fix something that isn’t broken. We must continue to prescribe financial prescriptions that help clients on their paths to financial salvation, resulting in a retirement of independence and dignity.